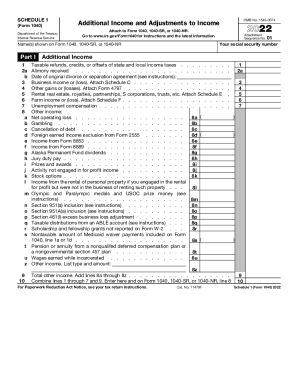

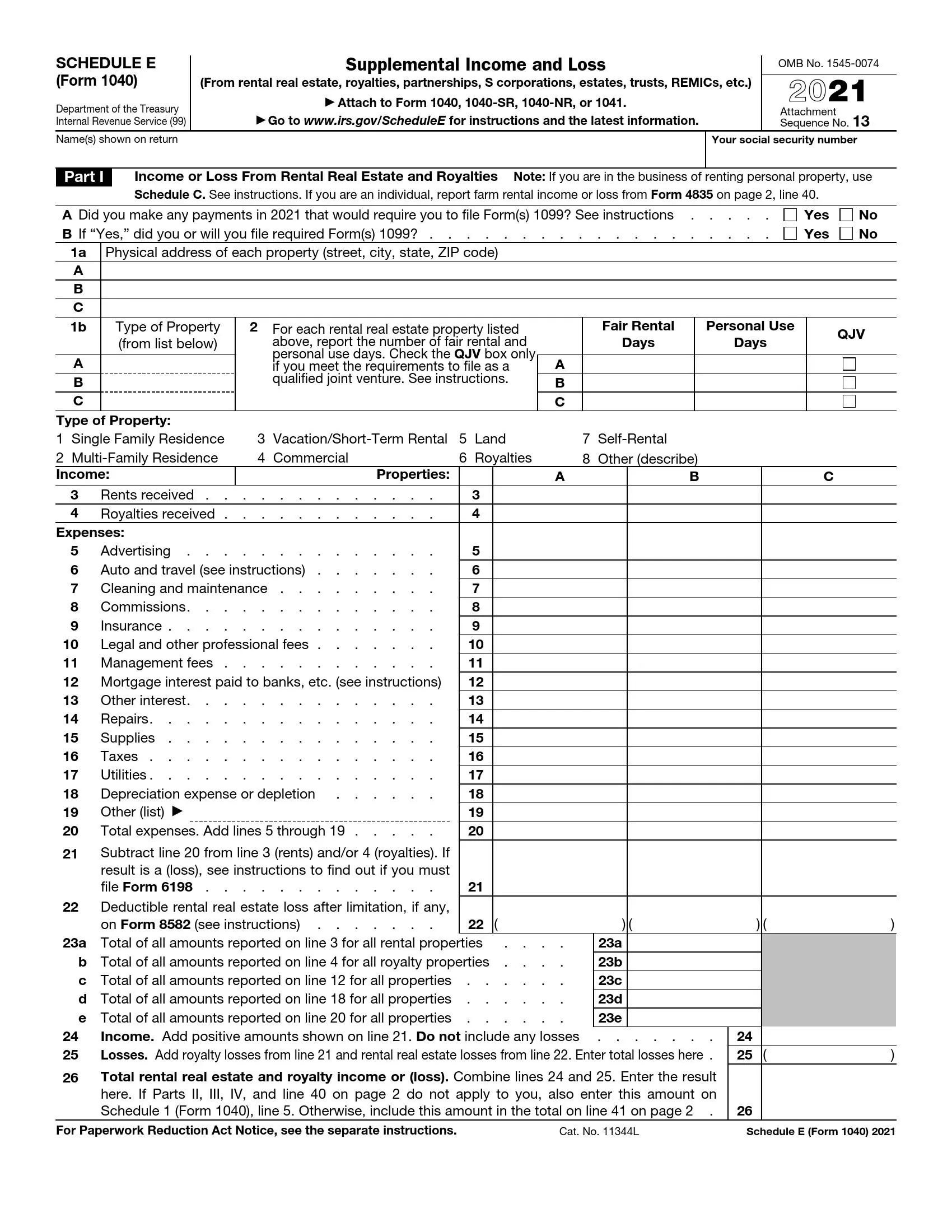

2024 Schedule A Form 1040 Tax Forms – As tax season approaches, taxpayers can access a wide range of tax forms, including Form 1040, Schedule A, and Schedule C. These forms are available in both PDF and HTML formats, making it easier . The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for .

2024 Schedule A Form 1040 Tax Forms

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.comTax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

Source : www.bscnursing2022.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comIRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms

Source : formspal.com2024 Schedule A Form 1040 Tax Forms All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: On 1/22/24, the IRS reminded taxpayers that they must again answer the digital asset 2023 question on Forms 1040 and 1040-SR and report loss on the transaction and then report it on Schedule D . The Internal Revenue Service has revised the question it has asked in recent years about income from digital assets such as cryptocurrency on the Form 1040 for individual taxpayers this tax season and .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)